Mission

Sharing expertise on financial instruments and operational skills in commodity markets.

MATHERIKA AKADEMY

“Where to grow your skills for financial markets and commodity”

The Program

1ˢᵗ lesson

with Antonio Lengua

Trading techniques

Dates available soon

- Introduction to volume analysis

- The principles of chart analysis

- Technicalities of derivative markets

- The decision-making process (Cognitive distortions & biases)

2ⁿᵈ lesson

with Antonio Gerli

Physical Commodities Markets

Dates available soon

- What is a commodity,

- Traditional commodity exchanges

- The Concept of Risk and the Concept of Hedging: Market instruments for Metals

(examples)

3ʳᵈ lesson

with StoneX

Brokerage & Financial Markets

Dates available soon

- London Metal ExchangeTrading Venues and contracts

- The Principles of Hedging and pratices

- Contango & Backwardation

- Futures/OTC Markets / Hedging with Options

4ᵗʰ lesson

with Enrico Darino

Financial Markets & Portfolio construction

Dates available soon

- Financial Markets & Portfolio Construction

- Equity Futures and Derivative

characteristics - Equity and strategies Options

- Volatilty, Contracts and strategies

All course sessions will be in English.

Antonio Lengua, a seasoned trader with decades of experience.

From institutional trading at Deutsche Bank to becoming a pioneer in volume analysis on

futures markets and applying mindfulness in trading, Antonio has navigated the

complexities of finance with remarkable success. Author of three books and a frequent

collaborator with Webank and Class CNBC, he now offers you a glimpse into his world.

Antonio Gerli, 30+ years of experience as a base metals trader; I covered every

role: from back-office to front-office, from stock management to documents validation, from daily

trading to annual contracts, from strategic development to CEO.

A 10 years involvement in photovoltaic fields development and management, an all-encompassing

approach to energy transition and a nerdish love for technology top my curriculum.

“I bring to the Akademy all of the above and a little zest, because passing on what we have learned

the hard way is the best and most rewarding accomplishment of a lifetime career”

The StoneX metals team specialises in exchange-traded aluminum, copper, zinc, lead, nickel, and tin products. We also trade a suite of ferrous products. Spanning more than 35 years, our metals experience and focus on client service rank us as one of the best metals firms in the world. As one of only nine ring-dealing members of the London Metal Exchange (LME) and a member of NYMEX/COMEX, our Category One membership offers distinct LME capabilities: OTC contracts, on exchange futures, active averaging desks, and partial tonnage. We provide clients with a full-service base metals trading capability and global access to the related financial markets 24 hours a day through offices in New York, London and Singapore. We are also a reliable and competitive wholesale supplier of precious metals.

As a Type One ring-dealing member of the London Metal Exchange we provide full-service trading capacities and global market access 24 hours a day.

LME products

- LME base metals (aluminum, copper, zinc, lead, nickel, tin and alloys – Aluminum Midwest Premium, Aluminum European Premium & Alumina), precious metals and a suite of ferrous products including steel rebar, steel scrap and iron ore

- Exchange traded future and OTC contracts

- LME options and TAPOs

- LME averaging

- LME warrants

- Partial tonnage hedging

- Multi-currency FX

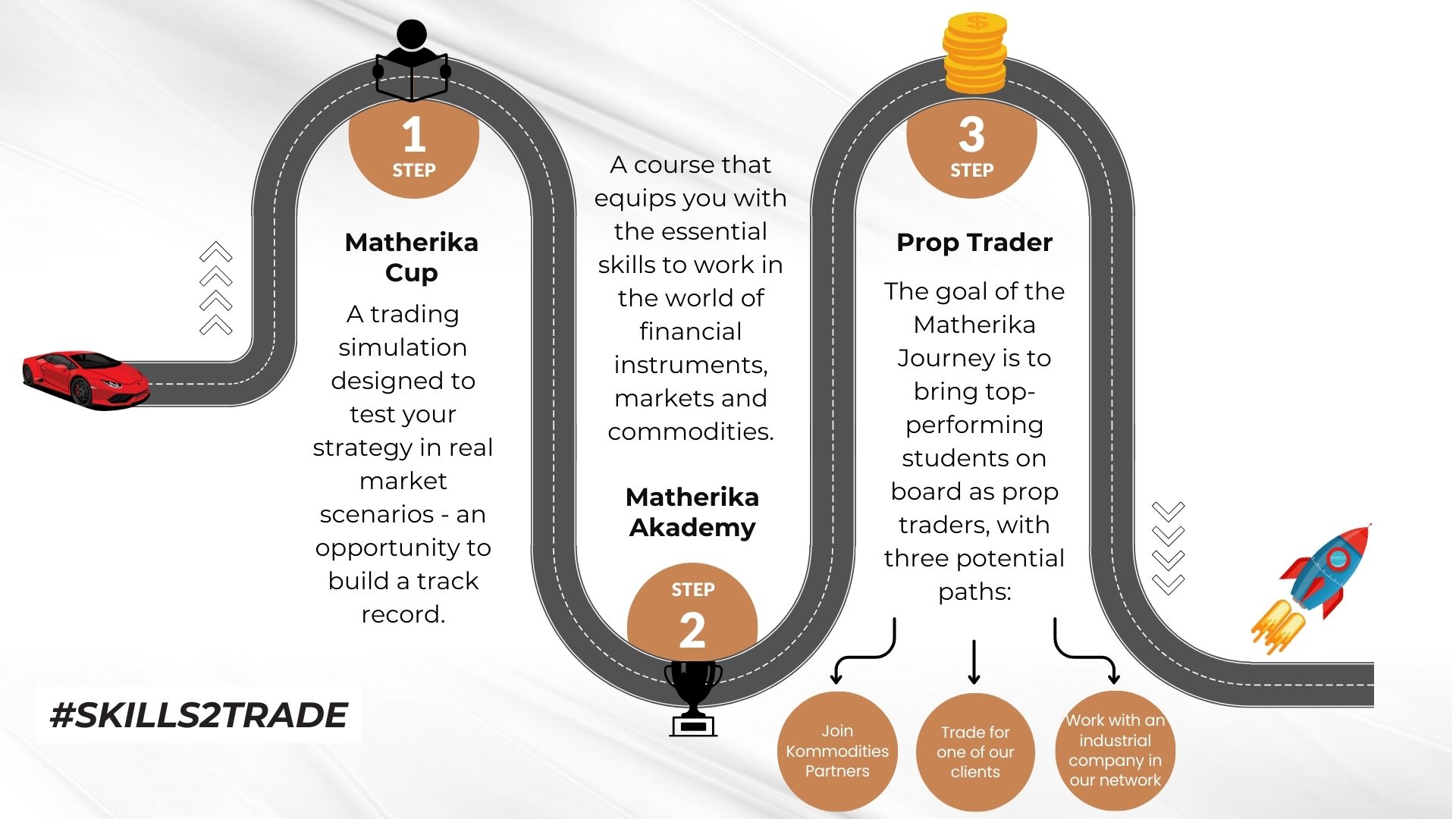

Do you want to win a Scholarhip?

Join the Matherika Trading Cup for a chance to win a full scholarship for the Young Talents course. And that’s just the beginning.

Explore all the exciting opportunities ahead!

3 Professional profiles for young people

The aim of the course is to raise the level of awareness among young people, guiding them to choose the path that best suits their aptitudes and personal characteristics.

If you are a student

Why Study at Akademy: The Advantages

- Luscher professional test, with the aim of identifying personal characteristics and affinities towards the three professional profiles designed by the Course

- Access to the ecosystem of industrial companies in the Matherika network, ( over 100 ): thus having the opportunity to be selected for an internship course

- Acquire knowledge and practical skills from the lecturers’ experience and thus develop one’s own knowledge and awareness of the markets and related financial derivative instruments.

If you are a company

Why become an Akademy partner: methods and benefits

- Gain access to the best talent on the course, trained in financial markets and commodities

- Bring your own testimony to the classroom and thus share the company’s experience and culture to attract and select young talent

- Maximum visibility within the training project and in communication

SCHOLARSHIPS

Finance the training of young talents through scholarships

ENROLL YOUR YOUNG EMPLOYEES

To enhance those practical and operational skills inherent in the Akademy programme.

ENROLL YOUR YOUNG EMPLOYEE – 2.500,00 CHF

What our students say

Alessandro Fosselard

The Matherika Academy is unique in the world of financial education. The course offers a practical approach that combines financial theory with detailed practice in commodities trading. Thanks to this program, I have acquired essential skills to excel in the world of trading.

Luca Rossetti

The Matherika Academy offers an unparalleled educational experience in the field of finance and commodities. Through a well-structured curriculum and highly qualified teaching staff, I learned the intricacies of trading and brokerage. I highly recommend this course to anyone looking to pursue a career in the financial sector.

Nicolò Colombo

Attending Matherika Academy was a unique experience. The program not only provides a solid theoretical foundation in finance but also delves into the practice of trading and derivatives sales. Thanks to this training, I feel prepared to tackle complex challenges in the financial world with confidence and competence.

Alisia Viali

The real added value of the course lies in its practical and realistic approach: through concrete examples and a stimulating environment, you will be able to apply your theoretical knowledge. Furthermore, the network created during the course, relationships with industry experts, and access to the Matherika Group environment represent another significant added value.

Eleonora Salcuni

The market analysis tools, presented lesson by lesson, combined with participation in the Trading Cup, allowed me to challenge myself and constantly improve, thanks to the feedback received and the interaction with Matherika’s traders. This experience, different from a purely academic path, proved essential in connecting with the professional world and helped me identify the career profile most aligned with my interests and abilities.

Francesco Bricchi

I was really impressed by the range of topics covered, as it helped me discover new areas of interest and better understand the path I want to take in the future. One example was the section on trading and technical analysis, which I only knew a little about. Thanks to the clear and practical lessons, I was able to learn more effectively.

Contact Us

Fill out the form for more information